A Buyer's Market?

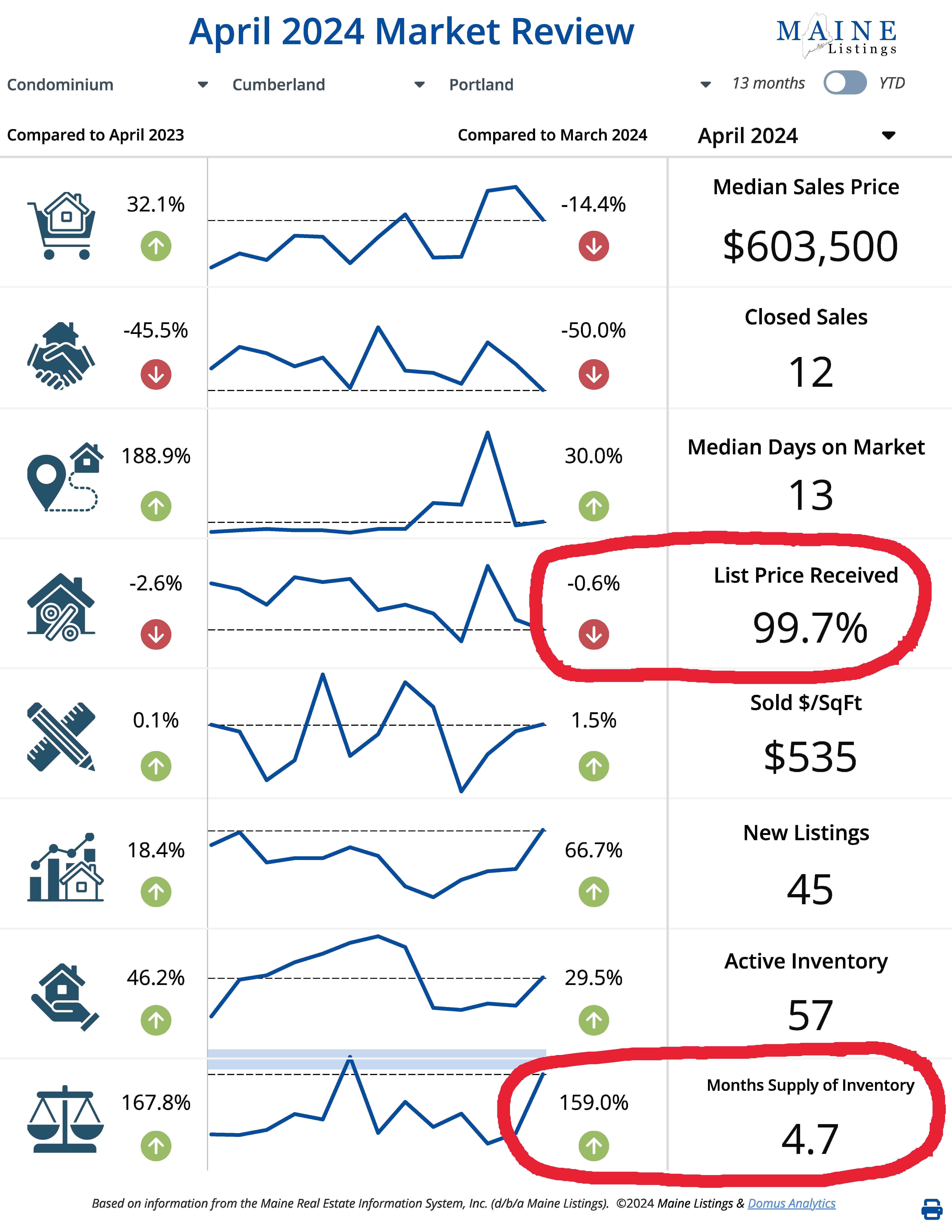

While the southern Maine real estate market is, undoubtedly, hot and every metric under the sun would indicate that it's still very much a seller's market, there are pockets that don't reflect the dynamics of the broader market. One such market is the condo market in Portland, in particular the new condo market. We've all heard it a million times, but pricing is driven primarily by supply and demand and it just so happens that Portland right now has a surplus of newly built condos, at least as compared to single family homes. For context, a real estate market is referred to as a "balanced" market when the Months Supply of Inventory is anywhere from 5-6 months. To clarify, that would refer to how many months it would take to sell all of the existing inventory if no new inventory was introduced to the market. You'll often hear real estate professionals refer to this metric to gauge who the market is favoring as it relates to buyers or sellers. Anything over the 5-6 month mark would be considered a buyer's market, whereas, anything less than that 5-6 month mark would be considered a seller's market, which is where we've resided in southern Maine for several years now. Below, you'll find that the Months Supply of Inventory for Portland condos (as of April 2024) was 4.7 months. While, technically, it wouldn't fall within that "buyer's market" territory, it's inching towards it.

Another metric worth noting is the List Price Received as this reflects the final sales price as compared to a home's list price. When a market is hot and multiple offers are the name of the game, it's typical that the List Price Received will be in excess of 100%, meaning that the home has sold for more than its original price. Below, you'll see that the List Price Received for Portland condos, as of April, was less than 100%, which means that some buyers were actually able to negotiate a lower sales price. While .3% off the sales price may not sound like much, it's certainly far better than what you'll find in the single family residence market, which we'll discuss below.

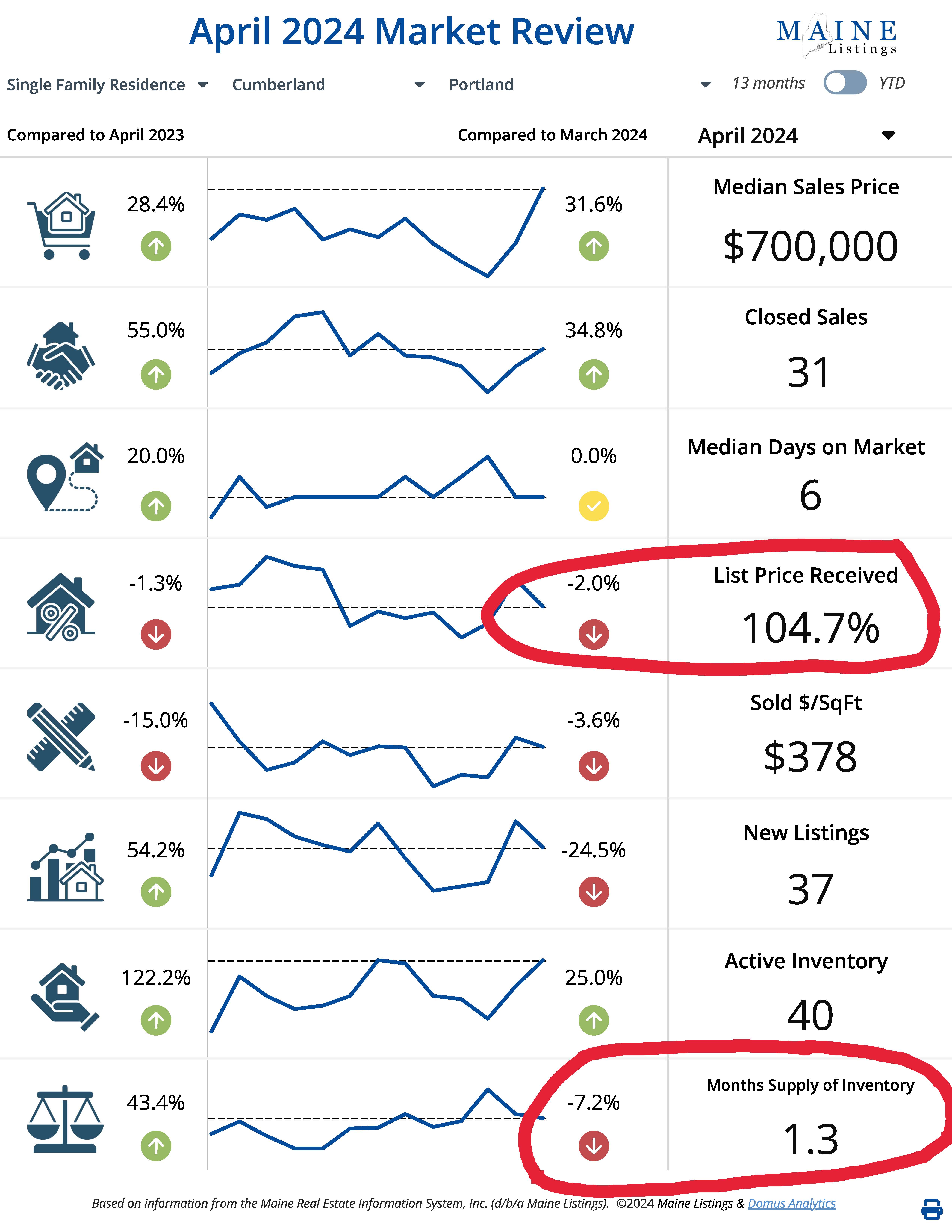

Now shift gears to the Portland Single Family Residence market in April and you'll see a drastically different picture when looking at the same metrics as above. For example, the List Price Received was 104.7%, which means homes sold for roughly 5% over their list price and indicative of multiple offers being received. Even more reflective of the single family home market being considerably different as compared to the condo market was the Months Supply of Inventory, which was 1.4 months in April (versus the condo market's 4.7 months).

So what does this mean for me you might ask? It means that if you're in the market for a newly built condo in Portland, you have options. Option as it relates to inventory and leverage when it actually comes time to negotiate a deal. While sellers may still try to dig in their heels on pricing, you'll at least be more likely to pay much closer to the home's list price as compared to battling it out with multiple buyers and paying a hefty premium. And who knows? You may even score yourself a deal, which is rarely said in this crazy market!

So what does this mean for me you might ask? It means that if you're in the market for a newly built condo in Portland, you have options. Option as it relates to inventory and leverage when it actually comes time to negotiate a deal. While sellers may still try to dig in their heels on pricing, you'll at least be more likely to pay much closer to the home's list price as compared to battling it out with multiple buyers and paying a hefty premium. And who knows? You may even score yourself a deal, which is rarely said in this crazy market!